[dropcap]S[/dropcap]now covers pockmarked roads, a crunchy backdrop to a husky crescendo promising ‘We won’t have to drive too far, close to the border and into the city.’

A conjuring of prose and clever song lyrics, as Ireland, grinds to a halt beneath a promised bombardment of snow, and a red warning for unnecessary journeys.

Tracy Chapman, however, croons on – ‘managed to save a little bit of money’ – salt in the wound if you are driving on your first insurance policy – ‘Won’t have to drive too far’ – more salt if your car is one of the many curtailed to both distance and speed by insurance companies who offer elevated policies in a market with more buyers than sellers.

Chapman promises – ‘You and I can both get jobs, finally see what it means to be living.’ For the thousands of young Irish drivers struggling to pay insurance policies and prove their maturity on the roads, insurance is a tracker mortgage nightmare.

Policies for young drivers (those who have not had the luxury of being insured on a parent’s policy) can average between €2,500 and €4,000.

Restrictions

Jonathan Hehir of Coverinaclick.ie says: “Parents taking out policies on what is essentially their son’s or daughter’s car, to get a cheaper premium, is something that has been prevalent in the past. But insurers are very strict on this and are now taking a zero-tolerance approach.”

Cathal Moore, is a 20-year-old student in NUI Maynooth, and was insured with Boxymo, Irelands first telematics insurer.

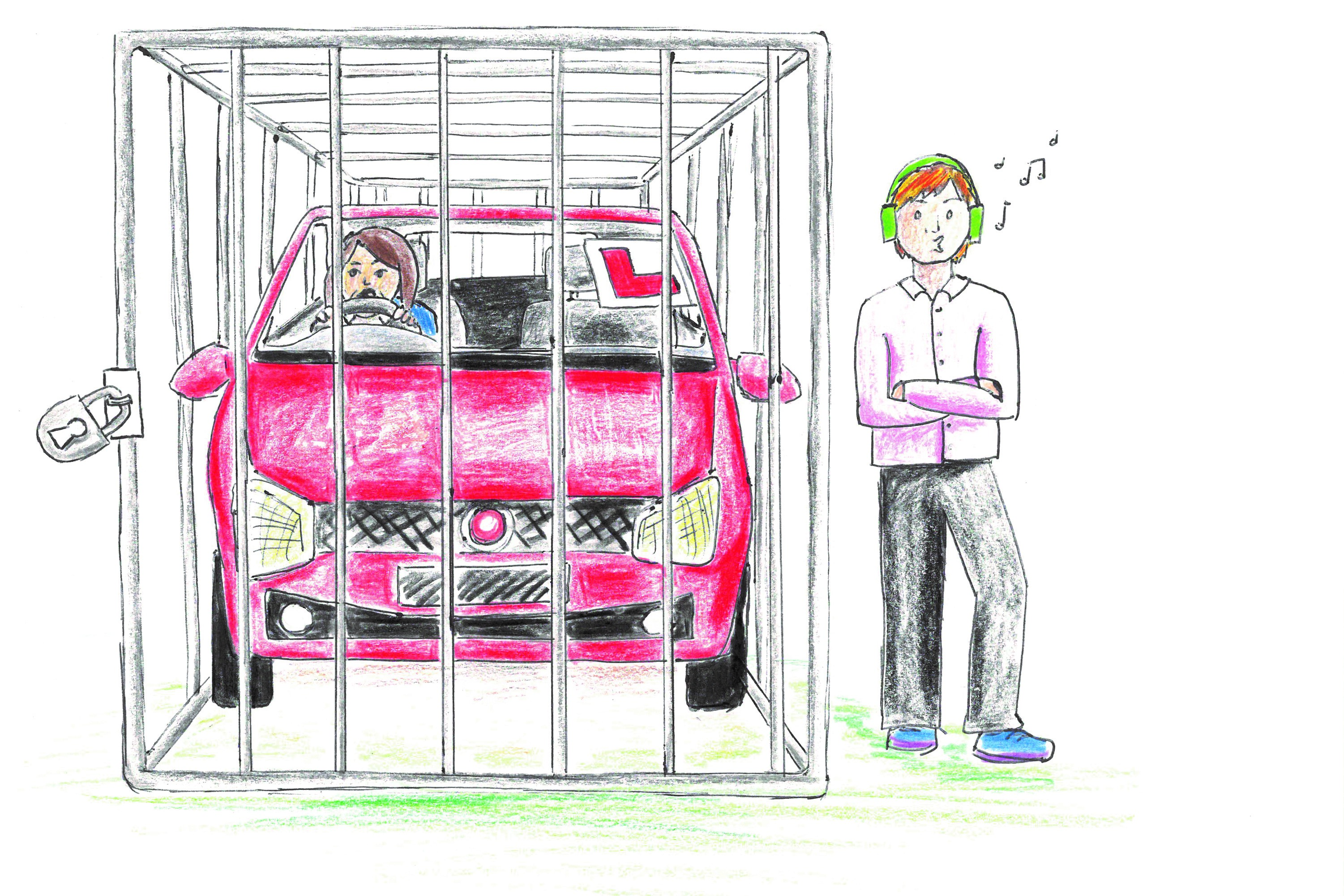

Boxymo fits a device which checks the speed and mileage used over the life of the policy. Penalties apply if mileage is exceeded or speed limits are not met. A bonus is offered for those who stay within speed limits, however, Boxymo were not able to clarify how many customers had gained that privilege.

“The mileage thing was annoying, having to be so careful and on some roads just not knowing what the speed limit was or where it changed. My experience with them overall wasn’t great. It was so hard to get in touch with them.” Moore says

Getting in touch is done through chat rooms – or Twitter, and while theoretically (apart from the costs) the system seems to promote better driving, a lot of policy holders feel its extortionate to be penalised when they have yet to make mistakes.

Anne Mahon’s son is also a Boxymo customer, he drives to work, she drives his car home. Anne says: “It’s absolutely ridiculous. I have been beeped, flashed, roared at while at traffic lights because the drivers behind me are not interested in observing the speed limit. I am surprised that this has not caused me to have an accident, let alone my son. I don’t think Irish drivers, especially those who have been driving for a number of years, have any respect for speed limits or those who observe them.”

Perhaps penalising younger drivers is not enough, particularly if they see that more experienced drivers are only interested in overtaking them and disregarding speed limits.

Moore says: “I think insurance companies are manipulating the fact that people have no other option, I don’t think its fair that people can’t get a chance of affordable insurance first and if they have an accident they can pay the repercussions.”

Statistically it is shown that prohibitive insurance costs are not a fix, and in the past year an Oireachtas Committee report criticised the insurance industry for, what it called soaring insurance premiums.

Hehir says: “Historically, young male drivers have a poor record when it comes to accidents and subsequent claims. As a result, the introduction of the Gender Directive delivers a situation whereby young female driver are impacted by the same loadings.”

Statistically

Statistics show younger drivers are less inclined to drink and drive, or speed due to insurance loadings, yet RSA statistics show that of the drivers killed on Irish roads in 2017, the highest risk age group was those aged 16-25 years (18) followed by those aged 66+ years (15).

22 percent of drivers killed were reported as not wearing a seatbelt, with RSA promo campaigns pushing this issue home, the question of vanity over safety is still to be answered.

Coverinaclick.ie notes “The Consumer Price Index recently revealed that motor insurance is down 11.7 percent between Jan 2017 & Jan 2018 – but if you speak to any young driver (under 25) or their parents, they will tell you that insurers are still looking for big money for these policies. “

Accidents happen – but cause and result are not always equal.

Cost should factor, but better education is key; perhaps the keys of drivers who have developed more bad habits need also to be examined.

Chapman croons – ‘You got a fast car – I want a ticket to anywhere – Maybe we make a deal – Starting from zero got nothing to lose.’